north dakota sales tax exemption

The use tax works in conjunction with the sales tax. Find sales and use tax information for North Dakota.

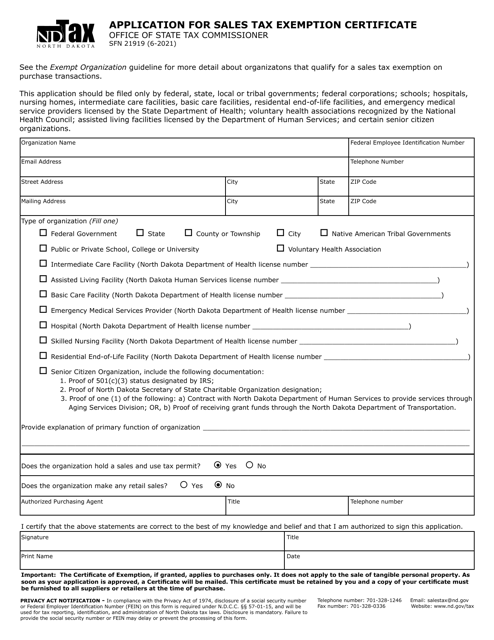

To obtain the sales tax exemption certificate eligible organizations must contact the Office of State Tax Commissioner.

. Complete Edit or Print Tax Forms Instantly. You can lookup North Dakota city and county sales. New farm machinery used exclusively for agriculture production at 3.

This page describes the taxability of occasional sales in North Dakota including motor vehicles. Talk to Certified Business Tax Experts Online. To learn more see a full list of taxable and tax-exempt items in.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Those groups that are exempt from North Dakota sales and use tax should contact the Offi ce of State Tax Commissioner to obtain an Exemption Certifi cate This certifi cate should be presented to the supplier when a retail purchase is made and serves to exempt the purchase from sales tax. Ad New State Sales Tax Registration.

How to use sales tax exemption certificates in North Dakota. For purposes of this. Tangible personal property used to construct or expand telecommunications service infrastructure in North Dakota is exempt form sales and use tax effective July 1 2009 through June 30.

2022 North Dakota state sales tax. 701 328-1246 State Tax Commissioner Website. North Dakota Tax Info.

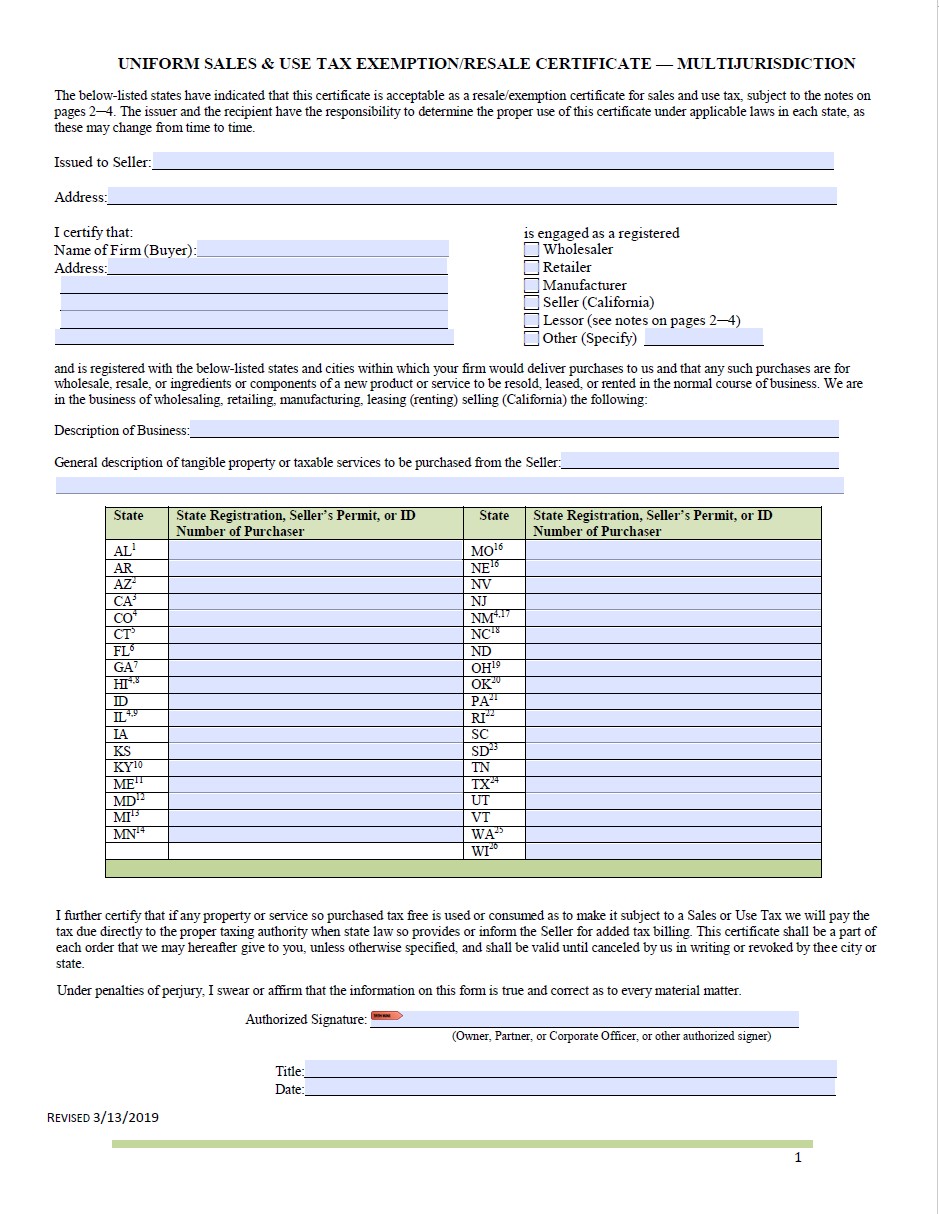

The state of North Dakota became a full member of Streamlined Sales Tax on October 1 2005. A North Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods from a supplier that are intended to be resold without the reseller having to pay sales tax on them. Additionally the state reduces the tax rate for business taxpayers purchasing new farm machinery for exclusive agricultural use to 3 percent and new mobile homes to 3 percent.

Local jurisdictions impose additional sales taxes up to 3. You can use this form to claim tax-exempt status when purchasing items. Exact tax amount may vary for different items.

The state of North Dakota levies a 5 state sales tax on the retail sale lease or rental of most goods and some services. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. Only groups possessing this certifi cate may buy.

For specific state guidance contact the state. Use tax is also collected on the consumption use or storage of goods in. The North Dakota sales tax law provides for a sales tax exemption on machinery and equipment purchased by new or expanding manufacturers.

Many states have special lowered sales. North Dakota tax exemption info. Ad 247 Access to Reliable Income Tax Info.

In the state of North Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. North Dakota sales tax is comprised of 2 parts. North Dakota has enacted legislation effective June 30 2021 that expands the sales and use tax exemptions for qualifying sales made to senior citizen organizations.

127 Bismarck ND 58505-0599 Phone. Gross receipts tax is applied to sales of. The maximum local tax rate allowed by North Dakota law is 3.

While North Dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified. The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656.

Several examples of exemptions to the state sales tax are prescription medications some types of groceries some medical devices and machinery and chemicals which are used in agriculture. Groceries are exempt from the North Dakota sales tax. Sales Tax Nd information registration support.

Form 301-EF - ACH Credit Authorization. North Dakota Office of State Tax Commissioner 600 E. Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically.

Ask Independently Verified Business Tax CPAs Online. Name and physical address of the project. To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail.

The sales tax is paid by the purchaser and collected by the seller. To learn more see a full list of taxable and tax-exempt items in North Dakota. Form 306 - Income Tax Withholding Return.

Tax permit number issued to you or your business by the North Dakota Office of State Tax Commissioner. Sales tax rates remote seller nexus rules tax holidays amnesty programs and legislative updates. This page describes the taxability of services in North Dakota including janitorial services and transportation services.

For other North Dakota sales tax exemption certificates go here. Form NDW-M - Exemption from Withholding for a Qualifying Spouse of a US. The range of total sales tax rates within the state of North Dakota is between 5 and 8.

Counties and cities can charge an additional local sales tax of up to 3 for a maximum possible. The letter should include. North Dakota has sales and use tax exemptions for specific products and services qualifying organizations and exemptions based on specific conditions and incentives.

Taxpayer name address Federal Employer Identification Number and North Dakota sales and use tax permit number. In addition agricultural commodity processors also may qualify for a sales tax exemption on building materials used to construct an agricultural commodity processing facility. These exemptions allow a person organization or business to purchase items without sales or use tax due.

Ad Access IRS Tax Forms. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. There are a few important things to note for both buyers and sellers who will use this form for tax-exempt purchases.

While North Dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Qualifying organizations include those that provide certain services for senior citizens including health welfare and counseling services. Buyers you must be certain that you are eligible for the exemption you are claiming.

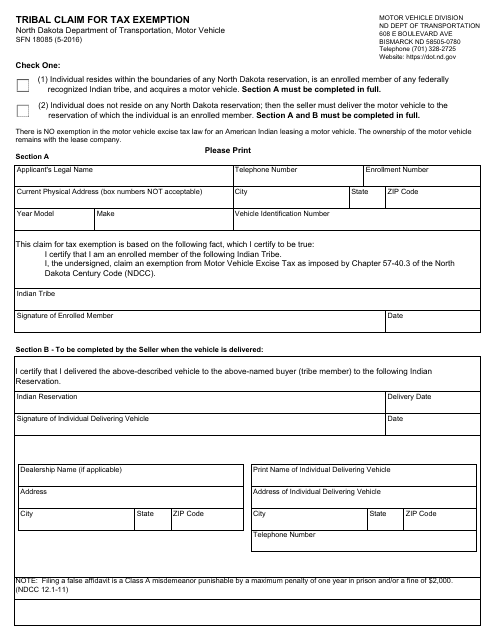

On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 35. Use exemption code 14 on the Application for Certificate of Title Registration of a Vehicle SFN 2872 North Dakota Department of Veterans Affairs - 4201 38th St S Suite 104 Fargo ND 58104-7535 7012397165. Currently combined sales tax rates in North Dakota range from 5 to 8.

The information on this site is general information and guidance and is not legal advice. North Dakota first adopted a general state sales tax in 1935 and since that time the rate has risen to 5. Get Tax Lein Info You Can Trust.

Some examples of items that exempt from North Dakota sales tax are prescription medications some types of groceries some medical devices and machinery and chemicals which are used in agriculture. In North Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 096 for a total of 596 when combined with the state sales tax. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. For purchases made by a North Dakota exempt entity the purchasers tax identification number will be the North Dakota Sales Tax Exemption Number E-0000 issued to them by the North Dakota Office of State Tax Commissioner.

The sales tax rate for North Dakota is 5 percent plus the applicable rate for local jurisdictions.

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

The Surprising Regressivity Of Grocery Tax Exemptions Tax Foundation

Form Sfn21919 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption Certificate North Dakota Templateroller

U S Bank Business Cash Rewards World Elite Mastercard Review 2022 Fuel Your Business With Rewards Reward Card Cash Rewards Small Business Credit Cards

Printable North Dakota Sales Tax Exemption Certificates

North Dakota Sales Tax Exemptions Agile Consulting Group

Sales Tax On Grocery Items Taxjar

Which States Have The Lowest Property Taxes

Form Sfn18085 Download Fillable Pdf Or Fill Online Tribal Claim For Tax Exemption North Dakota Templateroller

Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller